Car buyers may now benefit from a new tax break that allows them to deduct up to $10,000 in auto loan interest each year from their federal income taxes — reducing their taxable income.

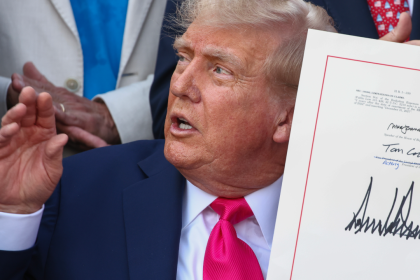

The provision, which is in effect for new cars purchased from 2025 through 2028, is part of the “big beautiful bill” legislation signed into law by President Donald Trump on July 4. The bill included several new tax breaks, both permanent and temporary, and extended certain provisions of the 2017 Tax Cuts and Jobs Act (TCJA).

Although the maximum deduction is set at $10,000 annually, most auto loans don’t accrue that much interest.

Unless you plan on buying a brand-new luxury vehicle within the next three years, you won’t see the full benefit of this deduction.

— Kellye Guinan

auto loans editor at Bankrate

Plus, there are some strict limitations on what qualifies for the tax break and how long it lasts.

Who qualifies for the new auto loan tax break?

Unlike some tax deductions, taxpayers can take advantage of the new car loan interest deduction whether they itemize or take the standard deduction.

But this tax break is available only for a limited time — it applies to qualified purchases made from 2025 through 2028 — and it has income-based limits.

- Single filers with a modified adjusted gross income (MAGI) of $100,000 or less qualify for the full deduction.

- Married couples filing jointly must have MAGI of $200,000 or less.

The deduction begins to phase out by $200 for every $1,000 over these limits and disappears entirely beyond certain thresholds.

Still, lower-income households may not see a significant benefit.

Because deductions are “based on your tax rate, households in lower brackets will save less,” says Lisa Greene-Lewis, a CPA and tax expert with Turbo Tax.

Someone who pays $1,200 in auto loan interest and is in the 10 percent tax bracket would save just $120.

— Lisa Greene-Lewis

CPA and tax expert with Turbo Tax

What vehicles qualify for the car loan deduction?

To be eligible, vehicles must meet the following criteria:

- Be a new car purchased with a loan on or after Jan. 1, 2025.

- Be assembled in the United States.

- Be a car, minivan, SUV, pickup truck or motorcycle.

- Weigh less than 14,000 pounds.

- Be used for personal (not commercial) purposes.

“Only new vehicles secured by an auto loan qualify,” Greene-Lewis says. “Leased vehicles, used cars and vehicles purchased for business use are excluded.”

Experts also caution buyers to verify manufacturing origins before purchasing.

“Even if you’re buying an American brand like Ford or GM, the final assembly must occur in the U.S. and the vehicle must be delivered to the dealership ready to drive,” Guinan says.

Boost your tax break with the EV tax credit

As part of Trump’s tax bill, the electric vehicle (EV) tax credit will be eliminated after Sept. 30. Until then, taxpayers can still claim up to a $7,500 credit for new qualifying EVs.

The EV credit was originally enacted in 2008 and expanded under the Inflation Reduction Act of 2022. Its repeal, along with other clean energy credits, limits planning opportunities beyond this year.

However, 2025 offers a unique window to combine the expiring EV tax credit with the new car loan interest deduction.

“Since the deduction is retroactive, any new EV purchased after Dec. 31, 2024, may qualify for both benefits,” Guinan says. “As long as your vehicle meets both requirements, you can deduct your auto loan interest and claim the tax credit.”

Taxpayers should note the difference in how each break works:

- The EV tax credit reduces your total tax bill dollar for dollar.

- The car loan interest deduction reduces taxable income, meaning the actual savings depends on your tax bracket.

“For instance, if you pay $1,200 in interest and are in the 12 percent tax bracket, you would save $144,” Greene-Lewis says.

Remember, you have until the end of 2028 to take advantage of the new car loan interest deduction. After this time, the credit will expire unless Congress extends it.

Why we ask for feedback

Your feedback helps us improve our content and services. It takes less than a minute to

complete.

Your responses are anonymous and will only be used for improving our website.

Help us improve our content

Read the full article here